Protectors of Health Strengthening the Health Insurance Sector with Sturdy Cyber Security

Health Insurance

Introduction

The health insurance industry serves as a crucial entity in safeguarding the financial well-being and healthcare accessibility of individuals and families. To adapt to the ever-changing landscape of technology, the integration of digital solutions and data-driven procedures has gained significant traction. In today’s era dominated by digitalization, wherein personal and medical data is frequently exchanged electronically, the importance of cyber security within the health insurance sector cannot be emphasized enough.

Technology in the Health Insurance Industry

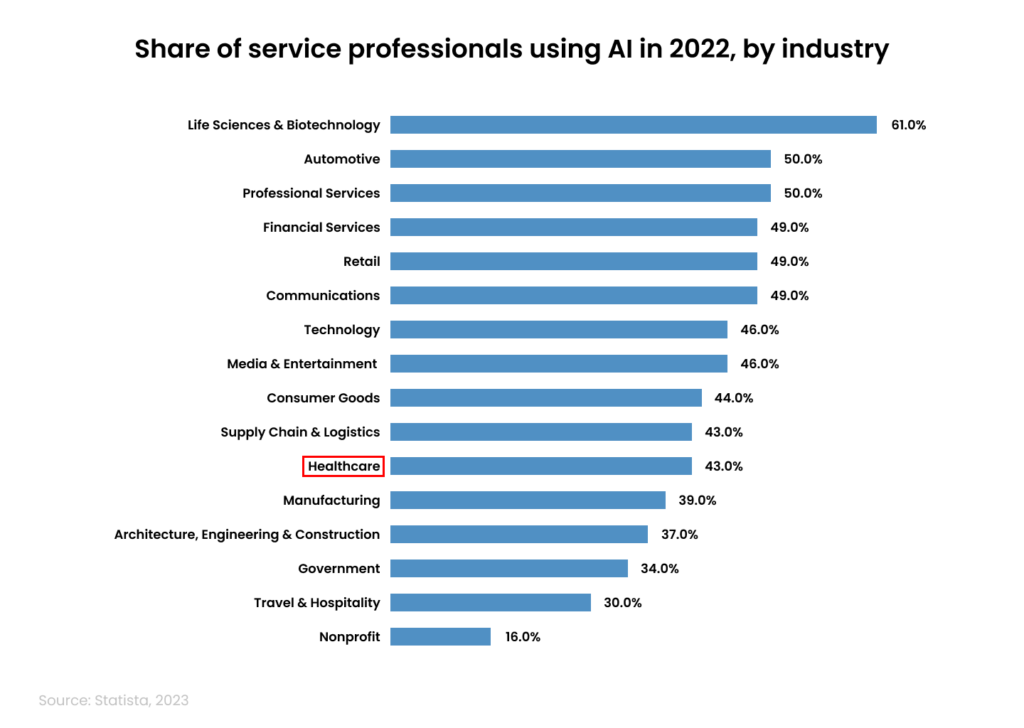

The health insurance industry has experienced significant changes due to the implementation of advanced technologies. These technologies have improved efficiency and customer experience by simplifying claims processing and allowing for personalized policy management. Electronic Health Records (EHRs), artificial intelligence, and data analytics are now commonly used, enabling insurers to make informed decisions, customize policies, and enhance overall operational efficiency.

Importance of Cyber security

Cyber security is paramount in the health insurance industry due to the highly sensitive nature of the information handled. Personal details, medical records, and financial data are all stored and exchanged digitally, making the industry an attractive target for cyber threats. A breach in cyber security not only jeopardizes the privacy of policyholders but also poses a significant financial and reputational risk for insurance companies.

- Protecting Sensitive Health Information: In the health insurance sector, the protection of sensitive health information is of utmost importance. According to a report by the Health and Human Services (HHS), the healthcare industry consistently experiences a high number of data breaches. Cyber security measures are crucial to safeguard patient information from unauthorized access, ensuring compliance with regulations like the Health Insurance Portability and Accountability Act (HIPAA).

- Financial Implications of Cyber Attacks: A study by the Ponemon Institute revealed that the average cost of a data breach in the healthcare sector is significantly higher than in other industries. The expenses associated with legal fees, regulatory fines, and reputational damage can be staggering. Robust cyber security measures act as a deterrent to cyber threats, reducing the likelihood of breaches and the subsequent financial fallout.

Conclusion

As the health insurance industry continues to leverage technology for improved services, the importance of cyber security cannot be overstated. Investing in robust cyber security measures is not just a regulatory requirement; it is a strategic imperative to protect the trust of policyholders, maintain financial stability, and uphold the integrity of the entire industry. As insurers navigate the digital landscape, a proactive approach to cyber security will be instrumental in ensuring the confidentiality, integrity, and availability of sensitive data, fostering a secure and resilient health insurance ecosystem.